Fragility & Boundary Conditions

I’ve had some thoughts over the last few months that felt very disparate, but suddenly came crashing together and unlocked a new insight, connecting how rain behaves to how startups fail. In short: it’s easy to make your startup fragile without intending to. If you are a VC-backed startup with grand ambitions, you may not want to, or be able to avoid this, but you should make sure that those decisions are intentional.

Fragility

I had a conversation over Christmas with a friend who runs a business selling firewood. His business is going really well. With energy prices and war in Europe, firewood is selling out everywhere. Over the last few years, he has scaled up by buying better machines and by employing one other person besides himself to make firewood. Given the demand for firewood, I’ve been pushing him to scale further and faster — I see him having the opportunity of a lifetime to make a big business while also providing a great service to a lot of local people in need of firewood.

However, he said “I don’t know if I want to, if I want to increase production further for next year, the business ends up becoming quite fragile”.

To produce more firewood than he already does, he would need to do all of these things:

- Build a larger undercover storage space to dry the freshly cloven wood

- Buy at least one more wood cleaving machine

- Hire at least one more person

The first two require large capital outlays now (which he can afford) and the last is a long term commitment to taking care of an employee. The capital outlays will increase costs via interest rates on debt and via opportunity cost (a machine standing unproductive is a large opportunity cost). This means that a larger volume of sales will be needed each future year to support this larger business.

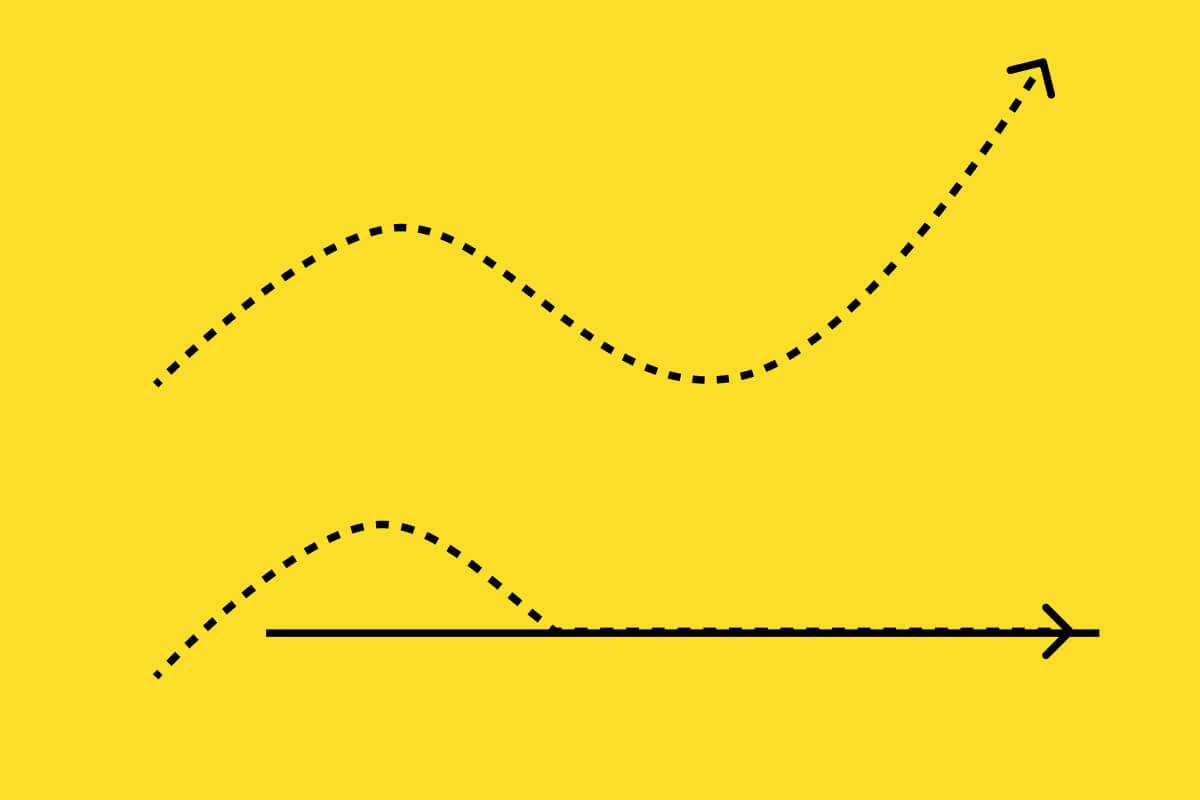

He’ll definitely make more money with this larger business, but he is also exposed to more risk. If there is a downturn in demand, more competition or some unforeseen circumstances, he can currently just switch to doing other jobs (he is also a welder) and put the firewood business on pause. However, if he ramps up production, he suddenly has significant interest payments to cover, as well as responsibility over several employees’ livelihoods. Ramping down a bigger business like this is not easy and risks bankruptcy. So he prefers to run a smaller, more robust business that he knows with high certainty will be sustainable for the rest of his life.

Boundary conditions

Have you ever noticed that when it’s raining, if you walk close to tall buildings in the city, you don’t get rained on as much? I’ve noticed this is true even for buildings without a “lip” of the roof jutting out and providing some cover — i.e. even for those flat modernist skyscraper buildings.

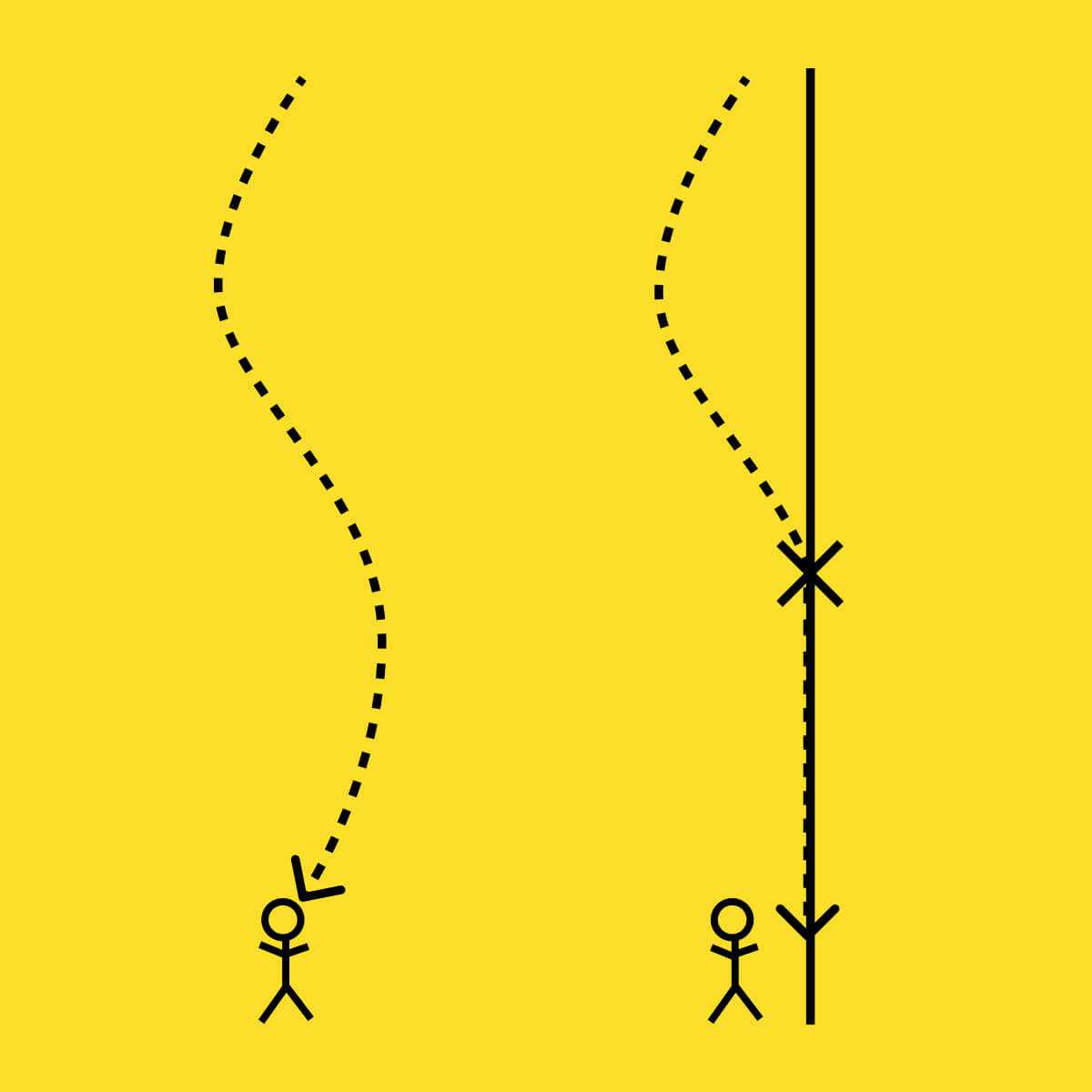

I think I've figured out what the reason is for this: the outer wall of the building acts as a boundary condition. On the way down, each raindrop gets buffeted by the wind, taking a snaky path through the air before it hits you. However, if you are near a building, any raindrop whose path intersects with the wall at any point, will slide down the wall instead of hitting you.

For startups, going bankrupt is a boundary condition. Things may go up and down in startups, but if you ever go into insolvency, it’s game over.

Fragility and startups

If you are a VC backed startup, you are not in the business of minimizing risk — taking big hits at ambitious goals is what you live and breathe. However, it’s important that you are aware of when you are making your business more fragile so that you can choose your battles and think through the tradeoffs.

A lot of the most successful tech companies went through near death experiences on their journey to success. If they had been set up to be more fragile than they were, those companies may not have lived to fight another day and we would not have the Slacks and Airbnbs of the world.

Here are a few common ways that increase the fragility of startups (VC backed and others). Note that I’m not necessarily recommending you avoid these — in many cases they will be unavoidable, or strategically extremely good moves for your business. However, you should be aware that you are potentially making your business more fragile.

- Debt and Venture Debt. You can almost always cut costs, but you can’t cut interest payments. If things go badly, but you are debt free, the worst case scenario might be to scale the team back to the founding team and go without salary. This is not an option if you have to keep paying interest. Additionally, if the debtor suspects that bankruptcy is approaching, they will trigger covenants that may cause bankruptcy much sooner than in a debt-free business.

- Long term cost lock-in (signing multi-year or minimum commitments with vendors). Similarly to debt, if you cannot pay your suppliers, this can trigger a bankruptcy and act as a boundary condition for your company.

- Few, large customers. Having your revenue concentrated among a few, high-paying customers means you are vulnerable to any single customer churning.

- Business critical suppliers without alternatives. The example of the day is OpenAI — if you are building a business that only works with GPT-3, you are hostage to OpenAI’s pricing, SLAs and APIs. If they change policy and ban your use case, you will have a hard time. Recently, with the SVB crisis we saw that this risk applies even to your supplier of banking services.

- Single founder. The classic example of a “bus factor” of 1. Even if you don’t get hit by a bus, getting sick or having a family emergency will be a lot more stressful as a single founder than if you have someone else to take on the burden of leading the business.

- Hiring people faster than growing revenue. Most startups are being de-risked in stages, unlocking funding as they go and therefore hiring people and growing costs to scale fast. However, if you are always relying on the next fundraise in order to continue, you are exposed to the risk of that round not coming through. This risk gets compounded if combined with debt.

- Raising money at too high a valuation. VCs probably overestimate the downsides to this, while founders tend to underestimate them. Fragility is introduced by the ecosystem’s aversion to “down rounds”. Raising money at a huge valuation amps up expectations of what should happen by the next round and correspondingly, spending will ramp up too, in preparation to meet those expectations. Not meeting those very high expectations may be de-motivating to employees and suspicious to future investors (who may be less likely to invest, even at a lowered valuation).

As a founder, it is important that you are aware of the boundary conditions you are facing (the main one to worry about being bankruptcy) and the choices you make that increase fragility. For fast-paced and exponentially-scaling VC backed startups, increasing fragility is often the only sensible option. Embracing intentional and considered fragility is one of your best competitive edges compared to incumbents — death is always a likely outcome anyway, so taking risks is par for the course.

If this unlocked a new concept for you or you are considering building something huge, let me know — my DMs are open on Twitter and we at byFounders are always looking to fund the next big thing in the New Nordics at the earliest stage.

Thanks to Ash, Ida, Martin and the broader byFounders team for their help in editing this post.