Competition and Slack

I am flying long distance for the first time in a long time — this time to the US for a festival. My experience with my flight being canceled made me reflect on how airlines work and the dynamics of the airline industry that have resulted in the way they are.

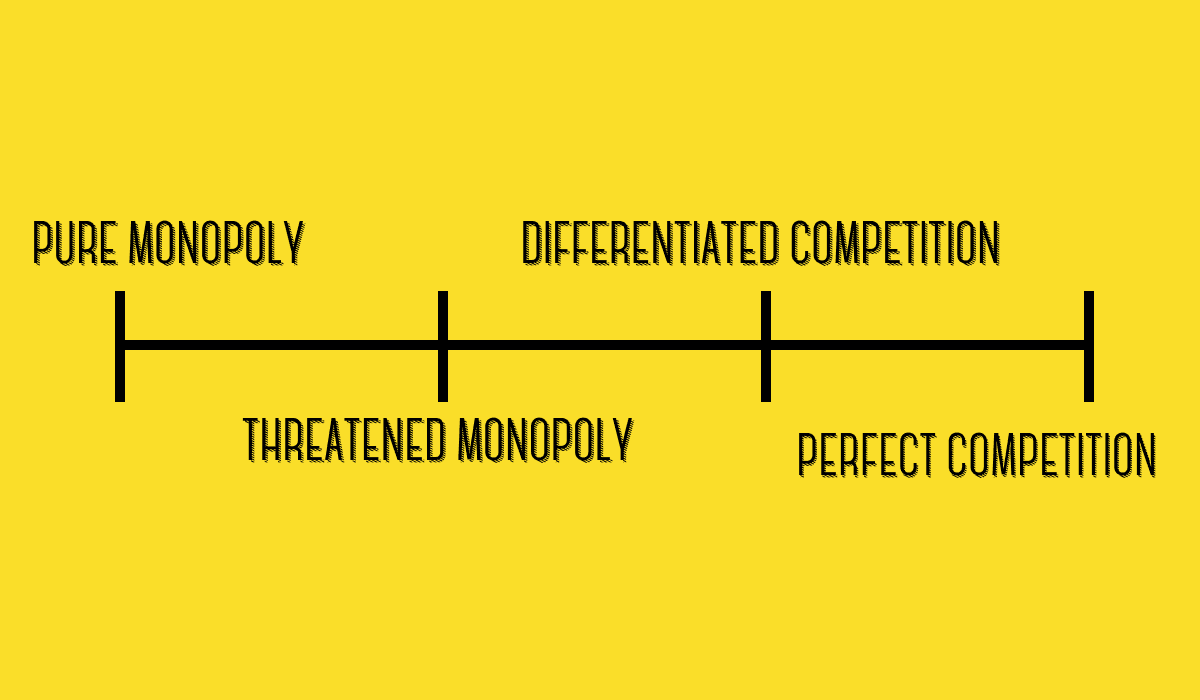

A useful framework that has come to mind is the classic one of competition, but in this case I want to examine what happens in the relationship between competition and “slack” in the system. In particular, I believe that there is such a thing as “too much competition”.

I will examine four distinct categories of competition, providing examples of companies and industries operating in each category.

Pure Monopoly

Examples: Arlanda Express, Systembolaget

Pure monopolies are relatively rare and typically result from some sort of regulatory protection. In these cases, monopolies often have a negative impact on consumers and society due to their focus on maximizing profits, which results in fewer units being sold at higher prices than they would in a competitive equilibrium.

Arlanda Express has a government enforced monopoly on the Stockholm <> Airport train route until 2040, and Systembolaget is a government-run entity that is the only business in Sweden allowed to sell alcohol for private use.

Arlanda Express charges $30 for a 20min ride per person and has very mediocre service. In fact, they have been maintaining their rail lines so poorly that they suffered a derailment a few weeks ago, putting a stop to all train traffic between Stockholm and its main airport for 10 days.

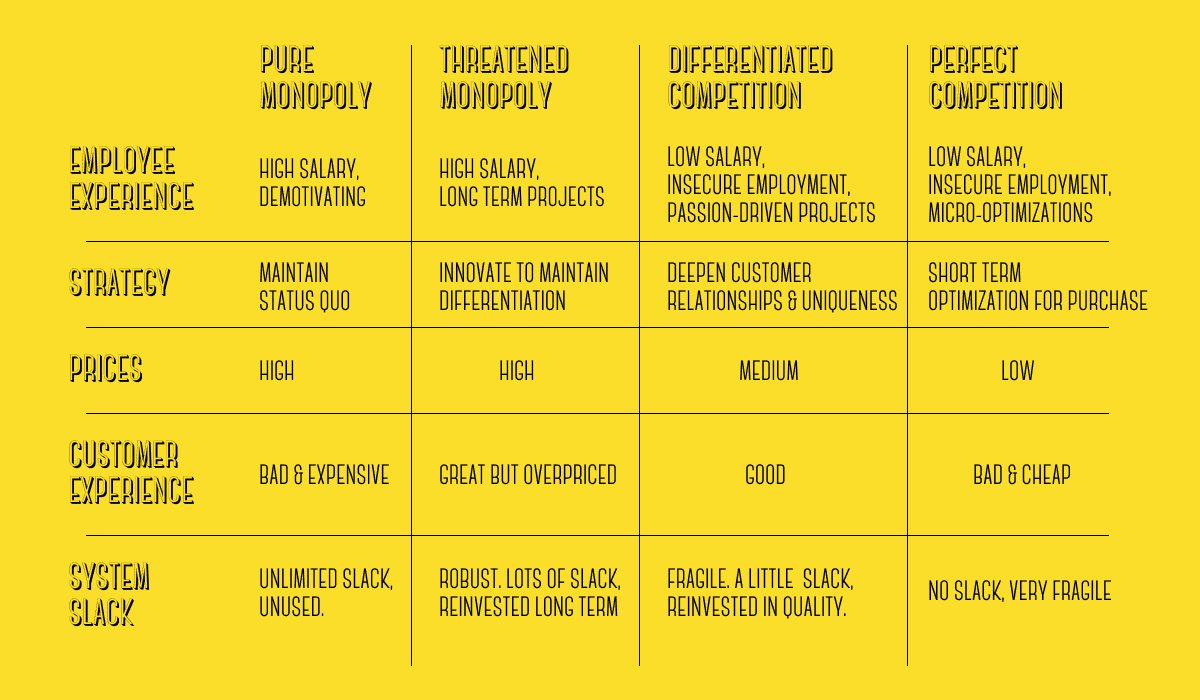

Monopolies have a fundamental problem of incentives. Since they are mostly government enforced, there is no reason to have a strategy beyond simply continuing to operate and cashing in. Working for a monopoly often feels stagnant — there is very little you can do to improve the business and in the long term, all that matters is maintaining its regulatory raison d’être. Monopolies have a lot of "slack" due to the lack of competition, but the slack in the system goes unused, creating a net drain on society.

Threatened Monopoly

Examples: Apple, Meta

Threatened monopolies are common among big tech companies. These businesses have strong differentiation in their products and services, making it difficult for competitors to gain market share. However, they are aware that their lead is not indefinite and that substitutes exist.

The classic example is Apple. Apple has competition in every product they sell, but they still have very differentiated products. Their differentiation stems from their ecosystem (the walled garden), and from their design and quality. Only a small fraction of customers are truly comparing Apple’s products to their competition when making a purchase, and the main decision factor is almost never price.

Threatened monopolies focus on the horizon. They know they have a great business already, so they focus on making the business last longer. They have a lot of slack in the system in the form of increased margins, and they will reinvest this slack into long term projects to try to maintain their differentiation. Employees are paid well, are encouraged to innovate and to think long term.

Customers overpay, but are generally ok with doing so. The system is relatively robust: it can do poorly for many years before competition finally overtakes it.

Differentiated Competition

Examples: Restaurants, mid-priced clothing brands

In this category, businesses sell similar products but have the opportunity to differentiate themselves over time, often by deepening customer relationships. Consumers often develop a strong loyalty to specific brands or establishments, which allows these businesses to maintain their competitive edge.

Operating a restaurant is famously hard — margins are tight, competition is intense and a single bad season can put you out of business. Many people start a restaurant as a lifestyle business and don’t care if it runs for a profit, making competition even harder for everyone else.

However, there is seldom a perfect substitute for a given restaurant’s exact cuisine and vibe. Customers can fall in love with a local restaurant and come back again and again, even if prices increase a bit or the quality goes down a little. They might know the owner, know their favorite dish or the location happens to be in their favorite neighborhood.

In industries defined by competition with differentiation, consumers generally benefit from high-quality products at relatively affordable prices. However, it can be a tough environment for employees, with limited slack in the system. Businesses in this category often allocate their scarce resources to improving product quality and enhancing their unique value propositions. These companies can be fragile, as their success is often closely tied to their reputation, which can be short-lived if not consistently upheld.

Perfect Competition

Examples: Airlines, cheap online marketplaces

At the extreme end of the competition spectrum, we find industries where competition is the dominant force. Here, the focus is on the moment the consumer decides to make a purchase, with all other aspects of the business considered as opportunities for cost reduction.

Airlines optimize their pricing minute-to-minute and tailor their checkout processes to maximize conversion and cart size. Everything that happens post-purchase is heavily cut, to the point where many airlines will require extra fees to print your boarding pass, be assigned a seat or get a glass of water on the flight.

Employees in these industries often receive low wages and are subjected to poor working conditions, with unionization being one of the few ways to maintain decent standards amidst aggressive cost-cutting. Customers, too, may not benefit significantly from perfect competition. While they enjoy lower prices, other aspects of their post-purchase experience are often compromised, such as customer service, legroom on flights, or food quality. The gap in time and mindset between making a purchase and experiencing the product makes it difficult for customers to associate the price paid or the seller chosen with the overall experience.

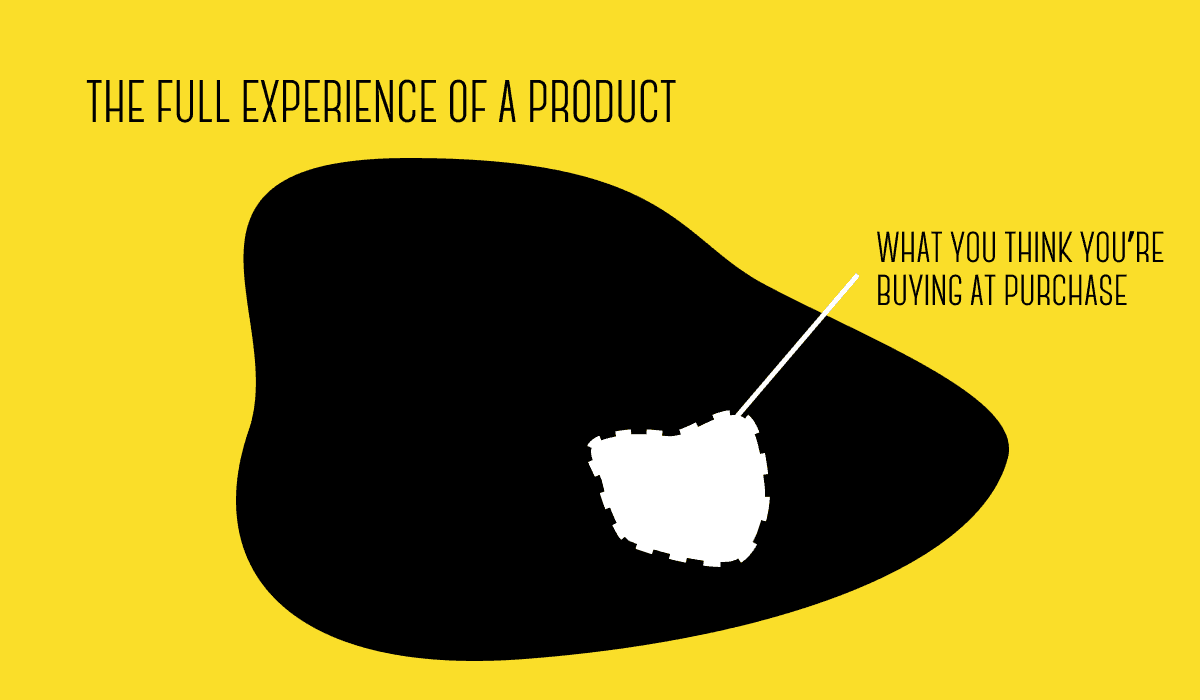

When you are making a purchase on a website, you are mainly thinking about the price and the few details you are shown on screen or can imagine are important. But the full experience of a purchase is always much broader and includes things that are impossible to keep in mind and consider fully: durability, customer service when things go wrong, the feel of the materials, legroom on the flight, noise, smell and many more things.

The relentless pursuit of competition tends to degrade the experience for all parties involved in the system. Companies operating in this environment have little choice but to prioritize short-term optimization over long-term strategy, as there is no slack available to invest in future growth. Short term optimisations stack and often lead to worse outcomes in aggregate than a single cohesive long term strategy would have.

The fragility of these systems is at a maximum: losing a few % points of margin due to inefficient costs will lead to demise.

Bonus special case: Legacy Oligopolies

Examples: Banks, telecommunications companies, utilities, insurance companies, railway companies

Certain industries are characterized by the presence of 3-5 large, old, and inefficient companies that continue to be highly profitable. These industries do not fit neatly into the competition categories outlined earlier, instead occupying a unique position somewhere between Pure Monopolies and Threatened Monopolies.

What these industries have in common are their age, heavy regulation, and tendency towards being "natural monopolies." A natural monopoly occurs when entering a market requires substantial investment, which is only justifiable if a large portion of the market can be captured. A classic example is the electricity grid: connecting a house to the grid is expensive and necessitates significant infrastructure investments. It is impractical for numerous companies to connect all houses in a country to compete. Instead, a few players build the network and share access as needed, paying government-mandated fees to avoid monopolistic rent-seeking locally.

This dynamic naturally favors a small number of players and fundamentally restricts long-term growth. Once a country is fully connected, expansion becomes limited (assuming other countries are also fully connected). As a result, innovation becomes less important and less incentivized.

Employees at companies within legacy oligopolies are paid decent but not great wages and are bogged down in bureaucracy. Innovation is rare, and customer experience tends to be subpar despite high prices (although prices in these industries are often subject to government-set ceilings). There is a fair amount of slack in the system, but it is spent on inefficient processes, bureaucratic bloat and shareholder dividends.

Summary

I believe society is best off with the two middle categories, biased towards the Differentiated Competition side. This category provides good prices for consumers, but also variety and enough slack to avoid over-optimizing towards price at the expense of illegible traits. Having a few (but not too many) industries in the threatened monopoly category, particularly in technology, allows for large scale private investment into future innovation, driving progress forward in a way that would be very hard if all industries were more competitive.

From an investing and startup founder perspective, you definitely want to aim for being in the “threatened monopoly” category, similar to the “competition is for losers” philosophy made popular in Peter Thiel’s Zero to One. This is the situation where you will be most likely to have sustained high margins and build a huge company consistent with the VC investment model. Unlike Pure Monopolies, the economic deadweight loss of Threatened Monopolies is much lower and decreases with time as competition catches up, so there is still a net gain for society at large by building a company like this.

Conversely, entering a Differentiated Competition market is generally not consistent with a VC return model. You can still make it as a healthy business here and run it at a profit, but in the long term, you should not expect the business to grow fast or become massive, because competition will adapt fast to your original point of differentiation.

If you are building the next Threatened Monopoly, reach out at magnus at byfounders dot vc!